BENEFICIARIES

Companies from any activity sector that are taxpayers of IRAE and have taxable income under this tax, and cooperatives, whose investment projects are declared promoted by the Executive Branch.

CLASSIFICATION OF PROJECTS

Investments falling under the following definition would qualify as eligible investments:

- Tangible, movable assets directly destined for the company’s activity, provided they have a minimum individual value of 500 UI (five hundred Indexed Units), excluding non-utility vehicles and movable assets intended for residential housing.

or Construction of real estate or fixed improvements on owned or third-party properties whose contract has a minimum remaining term of 3 years (excluding those intended for residential housing).

or Seedlings and the implementation costs of perennial fruit trees and shrubs.

- Electric passenger vehicles directly destined for the company’s activity, whose motorization must be exclusively electric, provided they refer to investment projects submitted between 10/07/2020 and 08/31/2023 and meet certain requirements established in the operating criteria of the Application Commission (COMAP).

The computable investments for obtaining the benefits will be those executed from the start of the fiscal year of the application for the promotional declaration, or in the 6 months prior to the first day of the month of said application submission, and for up to 10 fiscal years.

BENEFITS

The benefits that companies whose investments are promoted by the Executive Branch (PE) can avail themselves of are detailed below.

IP (Wealth Tax): o Fixed asset movable goods: exemption from IP on fixed asset movable goods that cannot be exempted under other benefits. The exemption period lasts for the entire useful life of these goods.

o Civil works: exemption from IP on civil works for up to 8 years if the project is located in Montevideo and ten years if it is located in the Interior of the country.

IRAE (Income Tax on Economic Activities): o Exemption from IRAE for a maximum amount and term resulting from applying the indicator matrix.

The percentage of exemption granted, considering the application of the general indicator matrix, will be at least 30% and can reach 100% of the amount effectively invested, considering that in each fiscal year the lower amount resulting from comparing the following can be exempted: the granted exemption percentage, the effectively invested amount, and 90% of the IRAE to be paid.

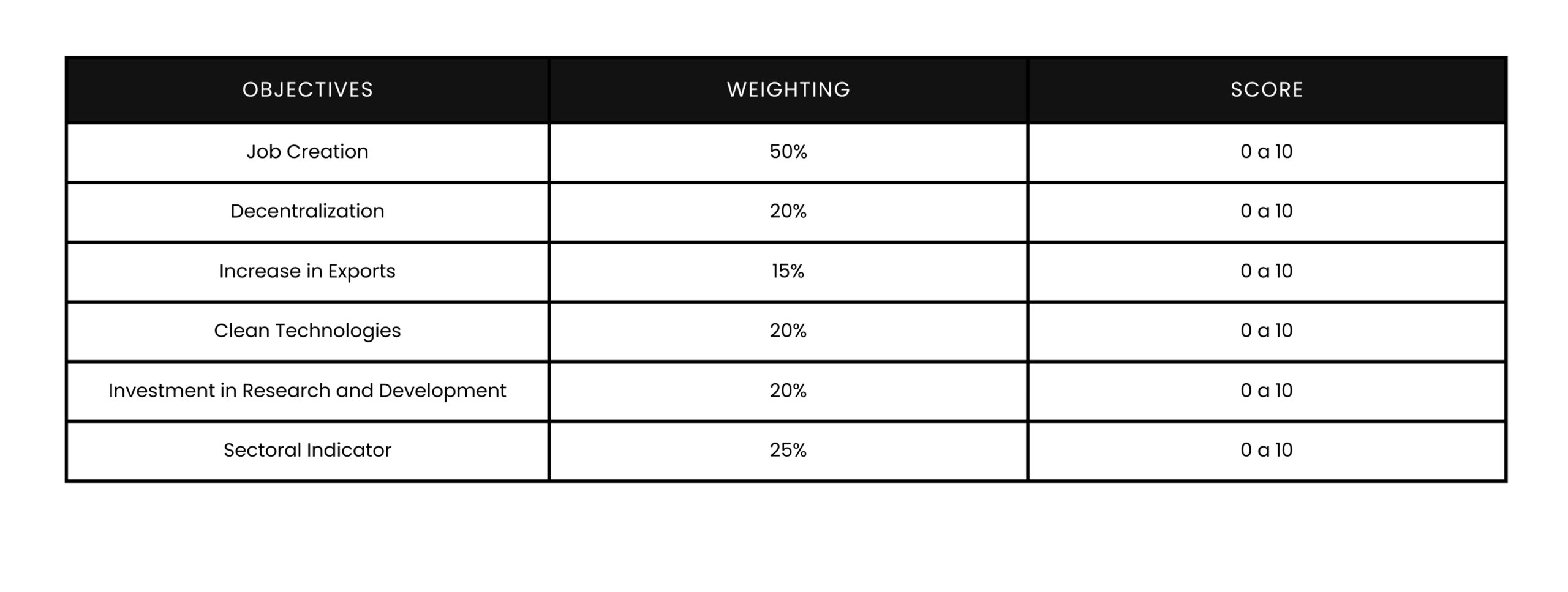

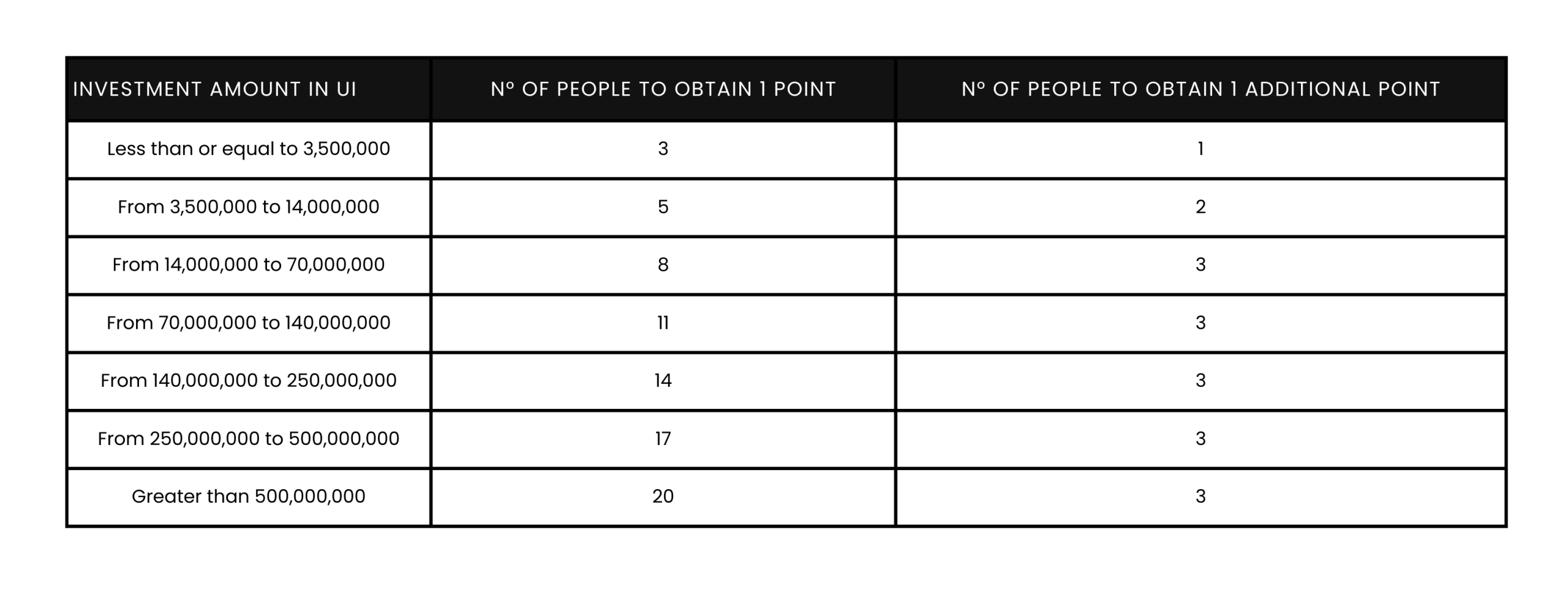

The granting of the IRAE exemption benefit is subject to the score obtained in the indicator matrix prepared by the Investment Law Application Commission (COMAP) based on information provided by the investor. The indicators composing the matrix for these projects are:

- Job creation.

- Decentralization.

- Increase in exports.

- Use of clean technologies.

- Increase in research and development and innovation.

- Sectoral Indicator.

As an additional benefit, micro and small companies, with investments of up to 3,500,000 (three million five hundred thousand) Indexed Units (UI), are granted an additional 10% (ten percent) IRAE benefit. Likewise, users of industrial parks and scientific-technological parks are granted a 15% or 5% increase on the exempted IRAE amount.

VAT (Value Added Tax):

- Refund of VAT under the exporter regime for the local acquisition of materials and services destined for civil works.

- Import duties or taxes:

- Exemption from import duties or taxes, including VAT, on movable goods for fixed assets and materials destined for civil works, which do not enjoy exemption under other regime benefits, and are declared non-competitive with the national industry.