FREE ZONE REGULATIONS

The promotion and development of the Uruguayan free trade zone regime has been declared a national interest, with the objectives of promoting investments, diversifying the productive matrix, generating employment, increasing the capabilities of the national workforce, increasing national value added, promoting activities with high technological and innovative content, promoting the decentralization of economic activities and regional development, and in general terms, favoring the country’s integration into the dynamics of international trade in goods and services, and international investment flows.

The regulations aim to dynamize and specialize the regime, incentivizing activities of special interest to the country and promoting new investments.

Likewise, the free trade zone regime is part of the path that Uruguay has been following in pursuit of the commitment to align tax incentives with international standards of guidelines and demands in matters of international taxation.

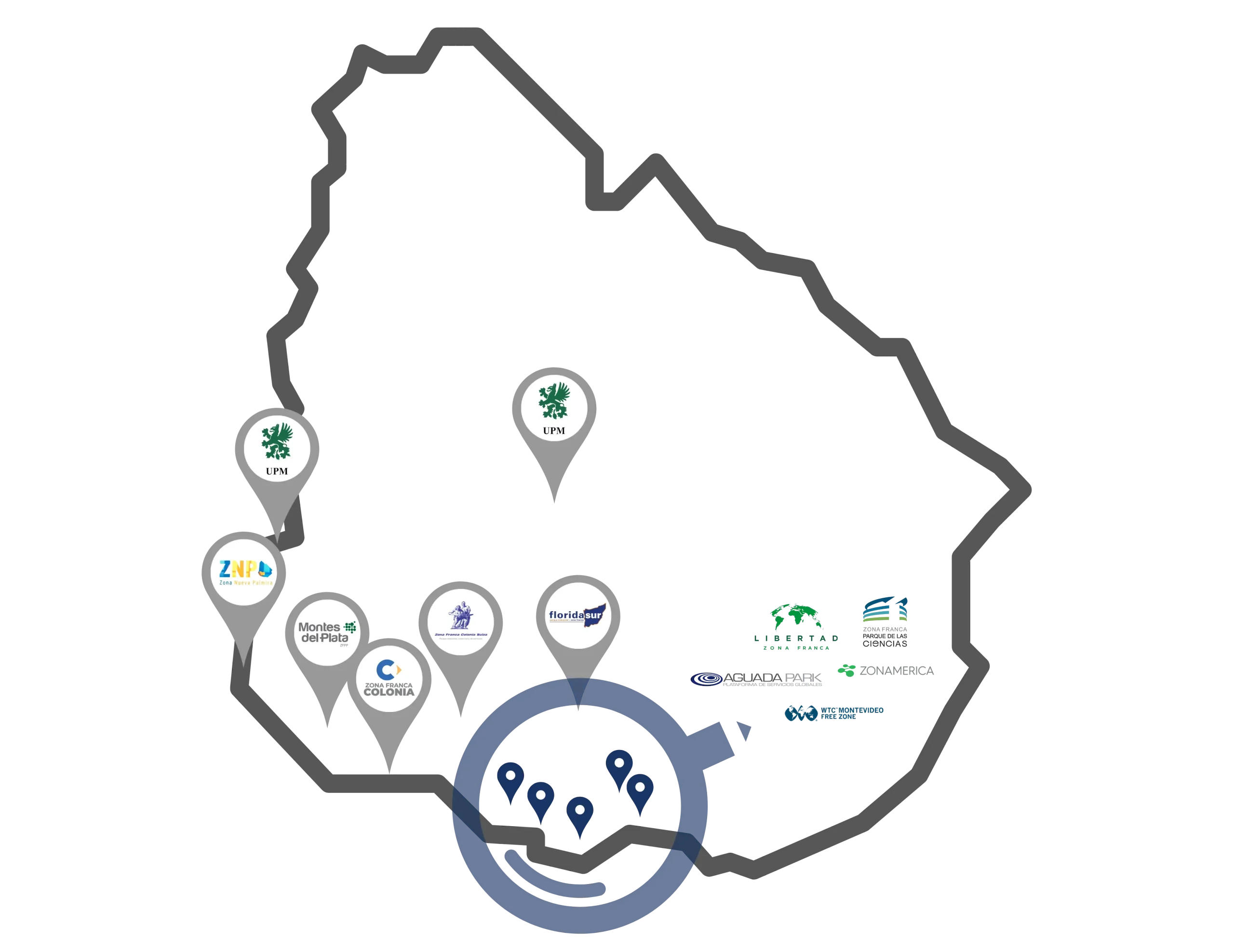

Uruguay currently has 14 free trade zones with diverse specializations, most of them located near the metropolitan area. These are: Aguada Park, Science Park, Colonia Free Trade Zone, Colonia Suiza Free Trade Zone, Plata Free Trade Zone, Florida Free Trade Zone, Libertad Free Trade Zone, Nueva Palmira Free Trade Zone, Punta Pereira Free Trade Zone, UPM Fray Bentos, CUECAR, WTC Free Zone, WTC Punta del Este Free Zone, and Zonamérica.

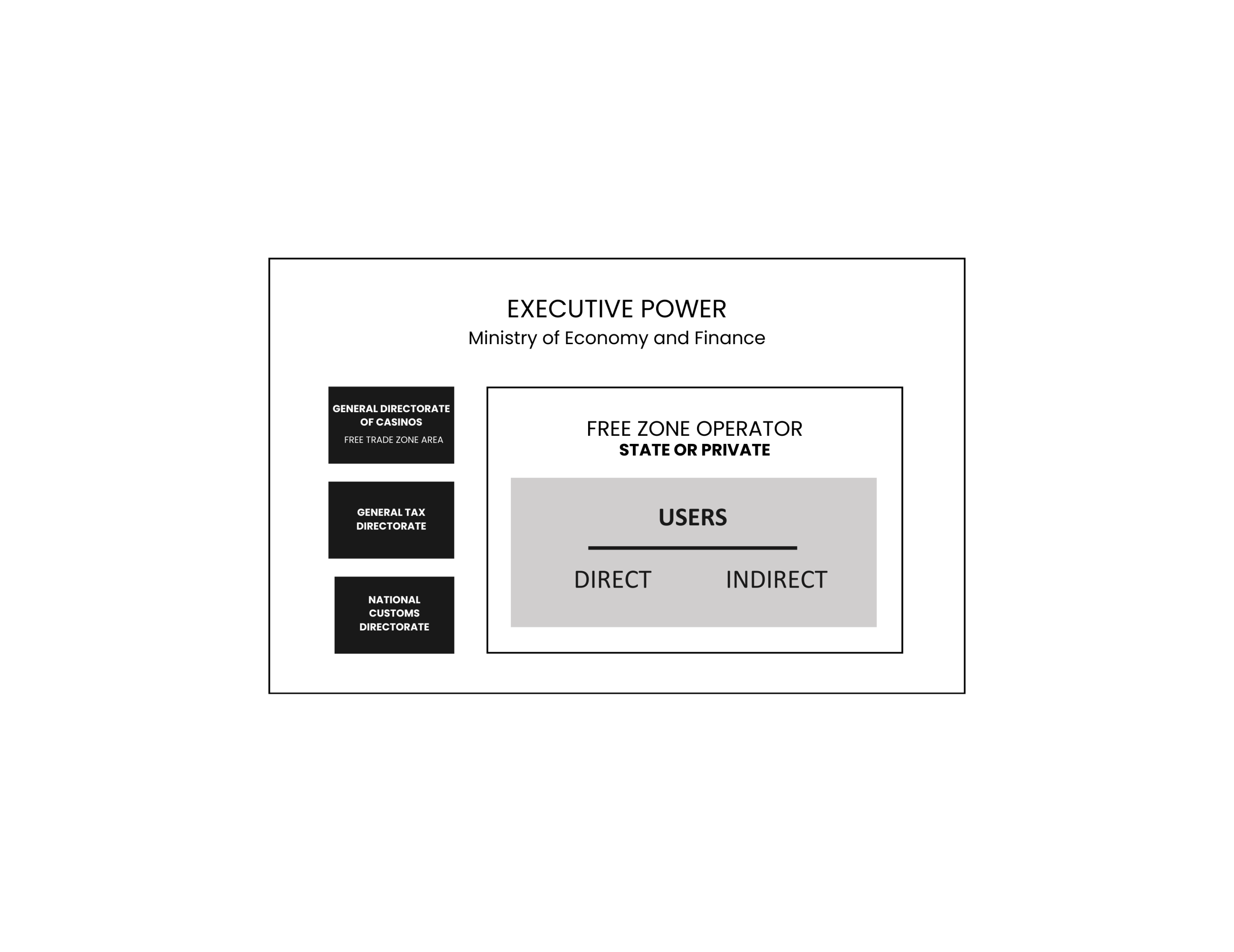

Operator | Developer:

Can be the State itself or a private entity. In this case, the operator or developer can be an individual or a legal entity and must provide the necessary and sufficient infrastructure for the installation and operation of a free trade zone, in exchange for a price. The authorization is, therefore, onerous and can be paid in a single instance or with periodic canon payments to the state, the most widespread modus operandi.

Users:

Are individuals or legal entities that acquire the right to carry out their activities within the free trade zone and cannot carry out any other type of activity outside of it.

There are 2 categories of users, direct and indirect. Direct users are those who contract directly with the operator, while indirect users contract with the direct user, using or taking advantage of the latter’s facilities.

ADMINISTRATION, SUPERVISION AND CONTROL

The administration and supervision is the responsibility of the Ministry of Economy and Finance (MEF) through the General Directorate of Trade (DGC) – Free Trade Zone Area (AZF). It is the main interlocutor organization for all regulations, permits, and controls related to all free trade zones in the country.

Following the approval of the Customs Code of the Eastern Republic of Uruguay (CAROU), Law 19.276 of September 19, 2014, the free zones changed from being an exclave to being part of the customs territory, therefore, under the control of the National Customs Directorate (DNA).

INTERNATIONAL BUSINESS PLATFORMS

Free trade zones are intended for the conduct of commercial, industrial, or service activities within them, with the benefits and under the terms provided by current legislation.

The introduction into free trade zones of weapons, gunpowder, ammunition, and other materials intended for warlike purposes is prohibited, as well as those declared contrary to the interests of the country by the Executive Branch (PE).

USER ACTIVITIES FROM THE FREE ZONE

Among the activities, the following stand out:

- Marketing of goods, depositing, storage, conditioning, selection, classification, fractioning, assembly, disassembly, handling or mixing of merchandise or raw materials of foreign or national origin.

- Installation and operation of manufacturing establishments.

- Provision of services under the following mechanism:

- From a free zone to other users located in other free zones.

- From a free zone to companies located in the non-free national territory: all types of services may be provided, provided that the company located in the non-free territory is a taxpayer of the Income Tax on Economic Activities (IRAE), which must be communicated to the free zone user and under the terms established by the General Tax Directorate (DGI).

- From a free zone to third countries.

- Others that, in the opinion of the Executive Branch, are beneficial for the national economy or for economic and social integration.

USER ACTIVITIES OUTSIDE THE FREE ZONE

GENERAL RULE

As a general rule, free zone users may not carry out industrial, commercial, and service activities outside the free zones. There are some exceptions to this rule, which are detailed below.

EXCEPTIONAL ACTIVITIES

Users may exceptionally carry out the following activities in non-free territory:

- Collection of overdue portfolios, provided it is carried out through third parties. Credits exceeding 180 days overdue are considered overdue. The Free Zone Area will control that the third parties providing the service are not related to the user and that they habitually carry out this activity.

- Exhibition of goods in Montevideo, only for users located in free zones outside the metropolitan area, in an area provided by the developer, and with prior authorization from the AZF.

AUXILIARY ACTIVITIES

The possibility is established to carry out certain auxiliary activities in non-free national territory, in a single fixed place, with prior authorization from the AZF.

COMPLEMENTARY ACTIVITIES

Free zone users located outside the metropolitan area may carry out the following activities, in a single place provided by the developer:

- Public relations.

- Handling of auxiliary documentation.

- Billing.

- Collection for goods and services from non-overdue portfolios.

TOTAL EXEMPTIONS

Users are exempt from all national taxes, created or to be created, including those for which specific exemption is required by law, regarding the activities they carry out within it, provided these are conducted within the framework of the law. Among these, the following stand out:

- Corporate Control Tax (ICOSA).

- Specific Internal Tax (IMESI).

- Wealth Tax (IP).

- IRAE (Income Tax on Economic Activities)

- Value Added Tax (VAT).

As mentioned above, the Executive Power may authorize the provision of other services from the free zones to the rest of the national territory. These activities will be subject to the general taxation regime, which may be established based on definitive tax withholding regimes, according to what the Executive Power determines.

CONTRACTED PERSONNEL

Users of the free zones shall employ, in the activities they carry out within them, a minimum of 75% (seventy-five percent) of personnel consisting of Uruguayan citizens, natural or legal, in order to maintain their status as such and the benefits and rights granted to them by this law. Temporarily, this percentage can be reduced, with prior authorization from the AZF. To do this, the reasons for the request must be stated. The aforementioned office will submit a report to the M.E.F. for its resolution, which will assess specific reasons related to the company’s activity, situations of starting up or expanding activities, reasons of general interest, and the consideration of the overall objectives set forth in this decree. The implementation of training plans may also be required so that users can achieve the minimum percentage required by the regulations.

The same procedure must be initiated before the AZF by those users who carry out service activities and intend to have a maximum percentage of foreign personnel equivalent to 50% (fifty percent) for the entire duration of the user contract.

CONTRACT TERMS

The legislation establishes maximum terms for free zone user contracts:

- Direct users: maximum of 15 years for carrying out industrial activities and 10 years for commercial or service activities.

- Indirect users: maximum of 5 years for carrying out any type of activity.

Likewise, it permits the authorization of longer contracts in the cases mentioned below:

Users of free zones located outside the metropolitan area must meet one of the following conditions within the first 3 years:

- More than 50 employees.

- Investment greater than 20,000,000 Indexed Units (UI).

Users of free zones located within the metropolitan area must meet one of the following conditions within the first 2 years:

- More than 100 employees.

- Investment greater than 40,000,000 UI.

REVOCATIONN

The AZF may revoke the user contract authorization when it is determined that there is a failure to comply with the established requirements and the commitments made in the investment project. Among others, it will be understood that non-compliance has occurred when:

- It does not generate employment in the zone in a proportion adequate to the activities carried out;

- It does not carry out its activities in the free zone.

- It does not have a fiscal domicile in the zone.